Three Years of Driving Post-Stroke

It was three years ago yesterday when I registered a used car I had bought, a 2004 Toyota Corolla. Â For the prior 12 months I didn’t own a car, I just had my trusty 49cc Honda Metropolitan scooter. But after my stroke I could no longer ride the scooter or a bike.

I felt bad about buying a car, I enjoyed not having the expense.

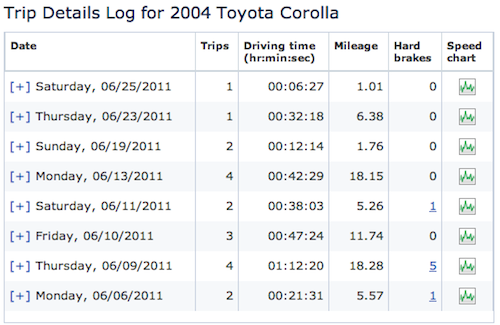

In the last three years I’ve driven just under 17,000 miles. About 4,500 of that was three trips to Oklahoma and two to Chicago leaving 12,500 for local driving. Many people drive this much, or more, in a single year. Granted, I don’t have to drive to a job everyday like most folks do.

But it has only been the last 10-11 months that I’ve managed to cut down my miles driven in half — by using public transit. Most of the time my car collects dust sitting in the basement garage at my building. I’d sell the car but it does come in handy at times. Insurance is the single biggest auto expense for me, the car is paid for and it gets decent fuel economy.

Thankfully Progressive Insurance introduced a program they call Snapshot.

With Snapshot, Progressive’s usage-based insurance program, you could turn your good driving into huge savings—of up to 30 percent—on your car insurance.

For the next 30 days, you’ll keep track of your good driving habits with the Snapshot device. You can log in to your Progressive policy anytime to see your projected Snapshot DiscountSM.

On day 31, your initial Snapshot savings—which can be anywhere from 0 to 30 percent— kicks in. After six months, you’ll send back the device, we’ll finalize your driving snapshot, and you can keep saving for as long as you’re insured by Progressive.

You can only save money with Snapshot—your rate won’t go up—but if at any point, you decide the program isn’t right for you, just call us and then send back your device.

Here is the annoying Flo to explain:

httpv://www.youtube.com/watch?v=ggWY7OPag0s

I’m nearing the end of my initial 30 days. I have to say I like seeing the reports, although I have more hard braking than I thought I would. I’ll report back after my initial savings and at the end of six months.

– Steve Patterson

In a larger (denser) city, taxis would be available enough that you could use them efficiently on the relatively rare occasions when neither walking nor transit is sufficient. The overall cost would be much less than owning a car.

In a larger (denser) city, taxis would be available enough that you could use them efficiently on the relatively rare occasions when neither walking nor transit is sufficient. The overall cost would be much less than owning a car.

Not necessarily. If you use a taxi once a week, maybe. If you use them several times a day and/or to go longer distances, prices add up quickly. Laclede Cab charges $2 to start the trip, $2/mile and $1 for each additional passenger. For that 6.2 mile trip between my home and work, that’s $15 + tip each way, $150/week + tip or $700+ per month, which is way more than I pay for my car note, insurance and fuel, making, in theory, all my non-commuting trips “free” ones.

Not necessarily. If you use a taxi once a week, maybe. If you use them several times a day and/or to go longer distances, prices add up quickly. Laclede Cab charges $2 to start the trip, $2/mile and $1 for each additional passenger. For that 6.2 mile trip between my home and work, that’s $15 + tip each way, $150/week + tip or $700+ per month, which is way more than I pay for my car note, insurance and fuel, making, in theory, all my non-commuting trips “free” ones.