Saving Cupples 7: The Importance of Urban Context

The Cupples Station complex is historic:

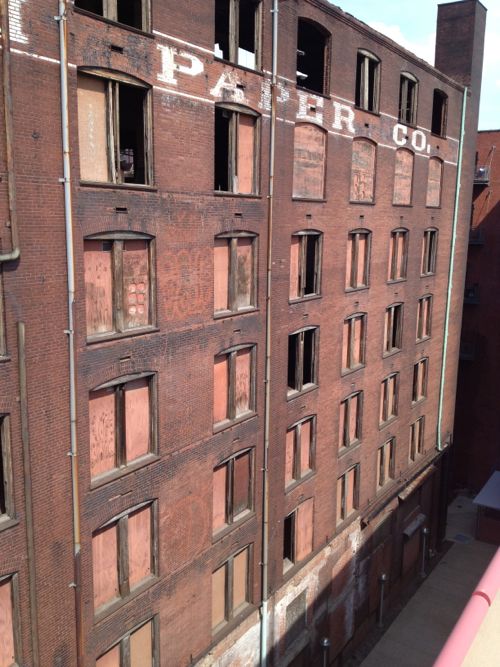

Name: Cupples Station Complex

Address: 7th to llth, Clark Avenue to Poplar Street

Architectural Firm/Architect: Eames and Young

Alterations: Several of the original buildings were razed for construction of Busch Stadium and Highway 40.

Designation: City Landmark, National Register of Historic Places,

History:

After the completion of Eads Bridge and the tunnel which connected the bridge with the Union Depot railway yards, Samuel Cupples and Robert S. Brookings saw an opportunity to locate warehouses with ready rail access to the yards. Their new warehousing idea saved considerable time in freight handling and was enthusiastically adopted by the local shipping interests. The resulting large group of multi-story buildings transformed a previously useless part of the city into a highly productive area. Since all of the warehouses were not accessible by rail, they were connected by a system of tunnels and bridges. A system of hydraulic elevators was provided for vertical access. The buildings were massively constructed and made as fire resistant as was possible.

Cupples Station played a major role in maintaining the preeminence of St. Louis as a railroad center in the first half of the twentieth century.

Architecturally, the Cupples Station buildings are of national importance. Although treated in the Richardsonian Romanesque style, the buildings are strikingly modern in feeling. Rounded brick cornices and soaring arches are common features of all of the buildings and serve to unify them. Each building, however, is different from the others in detail. Originally, there were 20 buildings in the complex. (source)

More important than being historic, the remaining buildings have a nice urban feel to them.

From my post Thoughts on Cupples #7 from December 2011:

In 2000 when Bank of America owned several of the Cupples buildings a tank collapsed causing a hole in the roof of #7. The hole was known five years later when McGowan & Walsh bought three of the warehouses, including #7. They attempted to tarp over the roof, right?

Wrong, they did nothing! Water poured in a small hole in the roof for five years prior to their ownership causing structural damage to get to the point where it is today — which is mostly in the basement. They’ve been irresponsible owners for years and now they are maneuvering to blame the city if this historic structure collapses.

The city certainly has failed, I’ve had to resolve issues like peeling paint or end up in court! Where has the city been? They condemned the structure in 2008 and

thatthen did…nothing. Everyone has been covering their own ass, but nobody has been trying to stabilize the building.

If this building collapses or is razed it will be a huge loss to the area. Walking east on Spruce St it helps from the street when you cross 11th Street (map)

— Steve Patterson

Shame on everyone involved.

Interestingly McGowan & Walsh (which have since dissolved their partnership) did the Ballpark Lofts at Cupples Station, a project that is now in the danger zone if #7 should collapse. A brilliant example of just how masterfully these guys could take a dump on people.

McGowan is a CROOK!!!!!!! SAVE CUPPLES #7!!!!!!!!!! NOW.

This building is merely one example of the hundreds, nay, thousands of potential historic rehab developments which would be nearly impossible to execute with severe cuts to the state historic rehab tax credit program. Frankly, while this building is significant, downtown has been the elephant at the water trough of historic tax credits. I’m more concerned with preserving the historic fabric in our outlying city neighborhoods. Downtown has lost most of its historic fabric anyway. Losing the historic fabric of our neighborhoods is the greater threat.

The other day I watched in horror as KMOV questioned why this building was still standing. I think we need to save the historic tax credits and the good urban fabric throughout the entire city.

What do they want? For this to be *yet another* surface parking lot?

They? What they? Who they?? Who are you talking about??

While I wholeheartedly agree that the outlying city neighborhoods deserve attention, I think this building deserves special attention given its *highly* visible location, its historical/architectural value, and its potential to actually be utilized fully if only it could be rehabbed.

Don’t you think downtown has received enough attention over the last fifteen years? And now $450 million more will go to the Arch. What about O’Fallon? Marine Villa? Cherokee?

I feel somewhat opposite. There are several fairly intact historic neighborhoods and thousands of historic houses in good use today in the city. While I would love to save everything, if I had to choose I would fight harder for commercial buildings, institutions and multi-stories like the Cupples. Especially Downtown. We have to try and preserve whats left of the fine thread of historic architecture that connects downtown and our historic neighborhoods and still gives this city an identity (even if its is half eaten by ugly parking garages)

You’ll have to explain just how Cupples connects downtown to historic neighborhoods. Are you referring to Lafayette Square and Soulard? If so, those neighborhoods are already saved. It’s the next ring that’s in trouble. How does Cupples connect to O’Fallon, Gravois Park, or Fairgrounds?

Someone needs to rehab this building NOW! Shame on anyone who wants to stop this! As Steve said, we MUST save the historic tax credits and ALL the good urban fabric throughout the ENTIRE city. WE MUST ACT NOW BEFORE IT IS TOO LATE!

Like many, many buildings throughout the city, no one is “stopping” this building from being rehabbed. It gets back to dollars – it’s going to make a bunch just to make it safe and stable, and a bunch more to repurpose it to serve modern residential or office uses. Are you willing to spend $200 a square foot to buy a loft/condo here? Are you willing to sign a lease for office space at $30 or $40 a square foot? People need to be willing to spend money, to create a market for this and other buildings. As for the historic tax credits, the guest at the top identifies the real issue, that the city has already received a lot of benefits from the program, and in a state where “no new taxes” rules, it’s an easy target for being reduced. We shouldn’t expect every real estate project to be subsidized by the government (since we’re all paying taxes) – most should be expected to be individually viable and self-sustaining.

Not only that JZ…but where is the blame at Bank of America. Did not the damage occur under their ownership?

I can see your point and exemplifies what banks really care about at the end of day, but I think in this case it is invalid because I don’t believe that Bank of America ever foreclosed on this particular property and therefore haven’t legally taken ownership. Lending money doesn’t mean they own it or obligated to maintain it.

Good or bad, right or wrong. I believe BofA has simply chosen to keep the loan intact while the developers are unable to neither pay the mortgage or taxes. This essentially puts the city on the hook on what to do at end of day because of unpaid taxes while BofA is willingly admitting to itself that they are writing off a bad loan because they don’t believe their is a prospective buyer nor want to take ownership. Two obvious reasons why they won’t foreclose. They must believe the cost of stabilization is more than what they think they can recover selling the structure afterwards or the cost of demolition is more then what they think the land is worth. Which is completely legal at the end of the day. The best hope is find an investor who is willing to put more money in then the market will give back in return.

We’re going to have to disagree tpeken. How is bank of America any different from McKee? If an entity takes possession of a property, they are responsible for maintaining it until developed or handed off to the next entity. To allow a hole in the roof to continue severly impacted whatever value was left in the building. The only fault with the City is that they did not enforce the codes nor do they (McKee again).

The difference is that BofA lended a developer money under a contract. They did not buy the property nor wanted to buy it anymore then Wells Fargo wants to own my house even though they loaned me money. The law gives BofA the choice to foreclose on a property and take possession of the property if the lendee can’t fulfill the contract. The return on the investment is in lending capital not real estate. Which gets to my point, I don’t believe Bank of America has actually taken possession in a foreclosure. Just because a lender can’t make payments means the bank owns or has obligations to the properties. Key word is choose, BofA actually has more then one option when not receiving payments. One option, do nothing and keep itself removed from any legal obligations to the properties.

Otherwise, The city would be in the position to do what I think your absolutely correct on. Enforce the code on an owner who actually has the means to follow through. .

You’re partly correct . . . the city has the ability to impose certain penalties to “encourage” a property owner to maintain their property, but as is evident in many neighborhoods (not just here), many owners are choosing to either ignore the sanctions or are choosing to pay whatever financial penalties the city imposes (up to and including forfeiting the property to the city) in lieu of spending significantly more to actually fix the problem(s). Unless the city actually and legally takes possession of a property, they can’t (legally) go on the property and put on a new roof. And, given our limited resources, we (the city) can’t put a new roof on every vacant structure that we currently own through non-payment of taxes. I know you get tired of hearing it, but it gets down to money – there needs to be perceived value to justify investing more money. It doesn’t matter who the actual, “legal”, owner(s) is/are, if the profit motive is absent / has gone away, why should “they” or “we” spend thousands or hundreds of thousands of dollars trying to save a structure that’s worth a fraction of what it once was? IF “The citizens of St. Louis [truly] want the city to be preserved and restored to its glory!”, it’s going to take convincing many (more?) people to invest in the city’s real estate, one property at a time (and that includes investing in maintenance, rehabbing and reoccupation, not just buying and sitting on land and vacant structures), not just expecting the LRA to be custodian of last resort for every undervalued property in the city.

Sounds good, JZ, but extending your logic to its current conclusion, and most rehabs in our lesser areas (a big chunk of St. Louis) would not be stand-alone financially feasible. So $100 million in tax credits for one downtown hulk, or maybe a whole city neighborhood? Deciding such choices will be the challenge for the 2013-2023 decade.

My point is that many projects around St. Louis aren’t financially feasible simply because there are few/not enough consumers for the product. We live in a city that has gone from more than 800,000 residents to fewer than 360,000. We have more structures – good, bad or ugly – than we need or can use, and we taxpayers have finite resources. We can play the shell game of taking my money to help save someone else’s historic structure, of taking my money to help a developer build another shopping center, or we can let EVERY property owner pay their fair share of what it takes to provide true government services. Tax credits and tax increment financing (TIF’s) aren’t free money, it’s money that is coming from other taxpayers’ pockets. If the city were willing to write me a check for a new roof or to tuckpoint my brick, sure, I’d take it, too, but that ain’t happening! Our problem isn’t inadequate government support, our problem is that people don’t want to live in the city! If you want to save historic structures and historic neighborhoods, both greater and lesser, you need to have enough people who love them for what they are to spend their own damn money on making and keeping each individual structure livable, maintained and loved (as it was when it was first constructed). Homes in Denver, Vancouver, Austin. Toronto, Brooklyn or Portland don’t sell for twice for what they sell for in St. Louis because they’re twice as nice or twice as big, they sell for twice as much because DEMAND for them is so much greater! People, of all ages, want to live and work there and are willing to pay for the privilege of being there. Until we get past the blinders and the negative perceptions that keep St. Louis off of too many people’s radar, we’re going to struggle with seeing our historic past crumble away!

Your population loss point is too simplistic. In 1950 we were a vastly overcrowded city with people finishing off basements to create additional housing units. With Urban Renewal and highway construction we removed many housing units. Much of downtown has been replaced by parking garages, surface parking lots, open green space, and sports facilities. When a newly rehabbed building becomes available for lease it gets occupied quickly. There is demand for space in these buildings not fulfilled by the market.

Steve is right that there is demand for newly renovated historic apartments and commercial space. JZ is correct that it takes huge subsidy to make the projects happen. And Guest is right that the lion’s share of those subsidies have been doled out in downtown projects. The neighborhoods are at risk, and for the city to be sustainable, the neighborhoods need an advocate. The problem is, except for a few (like the CWE, Soulard, and Lafayette Square), the neighborhoods aren’t sexy. You don’t see the likes of Walter Metcalf championing hundreds of millions of dollars in public spending for neighborhood revitalization like he has for the Arch. There’s no one except local neighborhood advocates pushing for neighborhoods. It’s not a level playing field. Downtown has all the big players, big money, regional advocates, sports teams, and the Arch. Yet neighborhoods have most of the charm and people who actually call the city home. It’s a weird dynamic. Add to that the fact that the poorest neighborhoods are in the weakest position.

Here’s a counterpoint, in Pittsburgh: http://www.post-gazette.com/stories/business/news/with-downtown-pittsburgh-office-space-tight-is-new-skyscraper-on-horizon-684364/ . … Their downtown office vacancy rate is in the 5% range (while ours is in the 20% range) and they’re looking at rental rates of $25-$30 per square foot (while ours are closer to $18 per square foot). http://www.stltoday.com/business/columns/building-blocks/st-louis-area-office-market-vacancy-rate-rose-in-first/article_a32d4f92-40f4-5735-afe6-c705d91766e6.html . . … It all gets back to supply and demand . . . .

Population loss means different things in different areas of the city. In some areas, mass rehabilitation and revitalization, in which many dozens of buildings are put back into use, are accompanied by a diminished population density due to the character (size) of the replacement households. In other parts of town, it IS simple abandonment, where whole blocks once at least sparsely inhabited become completely vacant. In my neighborhood, the 3400 block of Pestalozzi Street once had about a dozen old-time rooming houses, owned by one elderly woman who lived on the block. She was a great lady, southern Missouri’s answer to Lucille Ball. She wore kimonos and smoked cigarettes in a holder. Her apartment was a cross between Japanese traditional and Merle Haggard. Her “boys”, elderly men who worked odd jobs, paid rent by the week, cooked on hot plates, slept on basement floors, and sat on the stoops shirtless during warm weather, numbered in the many dozens. Density? You bet. It was a down-home 1950 on that block. In the late ’90’s, the woman sold her holdings to developers and made a killing. The developers then made a killing converting the warrens of one-room apartments to large, single-family homes and selling them to couples and small families. So, the sacrosanct density is severely reduced, but one can easily claim that the block, the neighborhood and the City itself are all better for the change. Also, admittedly, much less colorful.

Steve, you used to be a Realtor. You know that every real estate transaction involves many variables, but it all boils down to a willing buyer and a willing seller agreeing on a price. Prices are dictated by demand – little demand = low prices, high demand = high(er) prices. If there were “demand for space in these buildings” at a price developers could make a profit on, i.e., the market, this building would be redeveloped. It, and others, sit vacant because the profit potential simply does not currently exist. It’s the same reason why BPV is a shell of its original proposal and why we continue to see surface parking as the current highest-and-best use for many downtown parcels. Money doesn’t grow on trees. Concrete and brick cost money to buy and to install – it’s not much cheaper here, if at all, than it is in Chicago or Denver or Austin, but if you can sell / lease the finished product for more money than the sum of its part, someone’s gonna make it happen – profit is a great motivator! Yeah, with the clarity of 20/20 hindsight, the roof should’ve been maintained here. The reality is what we see today. It’s gonna take a lot of money to do something, anything, and we can’t always count on taxpayers (nor should we) to pick up the slack!

Lots of assumptions here….

“Someone” should subsidize it…

“Someone should develop it…

“Urban context is the most important aspect, costs and economics be damned…

“Downtown is where subsidies should be targeted…

Everyone has an opinion about what “someone” else should do!

It’s hard to have a willing seller when the owner had lock on all the properties and they were holding onto them until they put together their own deal. Then they split up and began suing each other. Other buildings in the Cupples Station have been rehabbed, one was just finished.

How many dollars in tax credits have gone into the total Cupples preservation effort? Washington Avenue? The Old Post Office area? The rest of downtown?

Downtown has seen the “Big Project” approach that “micro-developer” advocates decry, albeit, one project at a time.

Indeed, one reason the total tax credit system in the state of Missouri is under assault in the legislature a is because of all the credits pouring into STL. There are some who have even said, “St. Louis has recovered; the historic tax credit saved the day. Now we can afford time to cut back the program”.

Too bad for all those outlying neighborhoods, like O’Fallon, just now getting historic district statuses. Too bad, indeed!

For years many neighborhoods weren’t eligible for historic tax credits because historic districts hadn’t been created because prior aldermen opposed the efforts to create districts.

Steve, most of downtown is not in an “historic district” either. Laclede’s Landing and parts of Wash Avenue are about it. Downtown has individual buildings or groups of buildings (like Cupples) listed, but for the most part, downtown is not eligible for historic district status because so much of its historic fabric has already been lost!

There is no debating this basic St. Louis fact (and for those keeping score, the vast majority of “McKee-ville” doesn’t meet this standard): the majority of the historic fabric of the city of St. Louis is found in its neighborhoods; and, it is precisely those historic assets most at risk of demolition due to the lack of subsidy to underwrite the high cost of historic rehabilitation.

Correct, many downtown properties uses historic tax credits because they were individually listed or in groups, like Couples Station. In the neighborhoods you have far fewer buildings that could be listed individually so the only way to get historic tax credits is to group them in a district. But northside wards often weren’t even included in preservation review so many buildings were lost, making it harder to put together a district. Downtown can’t be blamed for incompetent leadership in neighborhoods.

Hyde Park has been on the National Register for decades, and it’s a big mess with buildings falling down before our eyes. Individual listings are usually done at the behest of developers hiring a historic preservation consultant to get a property on the National Register as part of an overall redevelopment effort. In other words, the market was there before the tax credit was being sought. It took the tax credit to make the project fully feasible. None of this addresses the problems neighborhoods face with the lack of resources to preserve those areas. The loss of state historic RTC will hurt downtown developers and neighborhood developers alike. The difference is, DT is pretty much back in business. The neighborhoods are still in the middle of a long climb to sustainability. They need all the help they can get, but resources for neighborhoods are getting harder to find.

True, but why didn’t Hyde Park take advantage during the boom? It had Freeman Bosley Sr. for alderman. Downtown was simply far less risky and it had its act together.

Freeman has been and continues to be a tireless advocate for his ward. He saw the potential in the historic three-story mansard at Salisbury and Blair years before developers put the deal together. And comparing downtown to Hyde Park? C’mon, Steve! Downtown “less risky”. Sheesh!

Until there was a state historic tax credit, downtown was a dead zone. It didn’t “have it together”. It was a no man’s land. You know that. So, heck, we might as well give credit where credit’s due. Credit Slay for the revitalization of downtown! Or perhaps Reed/Triplett and Young? No different than blaming Bosley for the downfall of Hyde Park! Right?

We must save Cupples 7! Someone must step up to the plate and be willing to see well into the future and sacrifice now what they have for a greater cause. That greater cause is our St. Louis culture and heritage. We will reap the rewards in the end. We must learn to think long-term, I mean 50 and 100 years down the road. Everything we do must be about the preservation of our city. Let’s fly our flags high. We must let nothing get in the way of our love for our city. We are St. Louis! CITY FIRST!

I nominate you for that “someone” – show me the money!

The money will show up when a plan is in place. The citizens of St. Louis want the city to be preserved and restored to its glory! We will succeed. In the middle ages, the citizens of many cities all came together with their resources to build magnificent cathedrals and town halls. It is the 21st century. We can do the same. SAVE CUPPLES 7

And the fans came to that ballpark in Iowa! Those same fans would do better to kick in their nickels and dimes to the ongoing Old North Kickstarter campaign working to save one of the vacant buildings there…

I’ll repeat, show me the money. As the Brookings Institute documents, the city has lost 27,000+ jobs over the last decade within 3 miles of the CBD, and another 38,000+ in the 3-to-10 mile ring around the CBD (for a total of 65,000+!), while suburban areas have gained (a slight net gain): http://www.brookings.edu/~/media/Multimedia/Interactives/2013/job_sprawl/St_Louis.pdf

Compare that to what’s happening in other cities – we’re obviously near the bottom when it comes to jobs in the CBD, and until that dynamic changes, there will be little incentive to do much with our many cool, old structures: http://www.brookings.edu/research/reports/2013/04/18-job-sprawl-kneebone

I prefer the vision set forth in the new SyFy series, “Defiance”, where the Arch is the only remaining artifact of the old city of St. Louis, and where, instead, its vitality is present in its people – not its vacant and abandoned buildings.

WE MUST SAVE CUPPLES #7!!!!!!!!!!!!!! WE MUST DO SOMETHING ABOUT THIS. THIS IS AN EMERGENCY. WE CANNOT LET THIS FALL! PLEASE, STEVE, WRITE SOMETHING ABOUT THIS SOON! WE CANNOT JUST SIT HERE AND ALLOW THIS TO FALL!

Cupples 7 will be only a memory by July 2013.!