Readers: Raise Missouri’s Fuel Tax

- Some are working to get a measure on a state ballot in 2014 to increase the state sales tax to fund road infrastructure. I don’t know the view statewide, but readers made it clear last week that increased sales taxes on all purchases is the least desirable option:

- Q: How should Missouri make up the shortage in funding for roads & highways? (pick 2)

- Increase the state fuel tax 79 [40.31%]

- Toll some highways 58 [29.59%]

- Increase auto licensing fees 31 [15.82%]

- Close unsafe highways/bridges rather than maintain/replace them 16 [8.16%]

- Increase the state sales tax 8 [4.08%]

- Unsure/No Opinion 4 [2.04%]

- Closing highways and bridges came in ahead of an increase in sales taxes. Here’s a look at how we got to our tax rate:

-

1992

-

A 6-cent per gallon increase in the motor fuel tax is passed by the Legislature. The 6 cents is to be phased in over a 5-year period; 2 cents in 1992, 2 cents in 1994 and 2 cents in 1996.

-

1987

-

Proposition A, a constitutional amendment to increase the motor fuel tax by 4 cents per gallon, is approved by the people. It becomes effective June 1. (MoDOT)

Where does this put Missouri comported to other states? Forty-fifth!

Some say fuel tax isn’t enough to do everything on MoDOT’s wish list. Probably true, but starting with fuel taxes is better than sales taxes. I also think tolling some urban highways is a good idea, I-270 comes to mind.

— Steve Patterson

what makes a highway a good candidate for tolling? im legitimately curious, not just playing dumb.

One that I don’t need to drive on everyday (or ever) – make “someone else” pay!

But seriously, there are two parts to the equation, generating enough revenue to cover the cost of tolling (busy roads or bridges are the most likely candidates) and having a justifiable reason for imposing tolls – our roads have already been paid for (when it comes to construction) and ongoing maintenance is the primary reason for paying our fuel taxes. Most current toll proposals assume that an additional lane will be added and that tolls will be charged only for the new lane, presumably because it will be less congested. However, in some states (Florida and Texas come to mind) completely new toll roads are being constructed, especially to serve growing suburban areas.

The real challenge, as MoDOT has identified, is that MoDOT has been given responsibility for many rural roads that in many other states would be the local county’s responsibility, not the state’s. For example, MoDOT maintains more lane miles than their counterparts in Illinois and Kansas, combined – http://www.missourionthemove.org/ . . While this can be “blamed” on a rural-focused legislature, the reality is that it won’t be changing anytime soon, for very real political reasons.

As for I-270, I seriously don’t see that happening. There are too many current access points and too many parallel alternatives, with 141 and Lindbergh being the most obvious ones. A better option, given our geography, would be adding tolls to all of our bridges over both the Missouri and the Mississippi Rivers. Doing so could help make urban living more attractive, but would obviously be opposed by suburban interests in both Illinois and in St. Charles County. Unfortunately, given the Law of Unintended Consequences, it could also make suburban living and working more attractive, if suburbanites could avoid crossing either river, altogether.

Toll an urban highway, and MoDOT will never get a fuel tax passed. Ever.

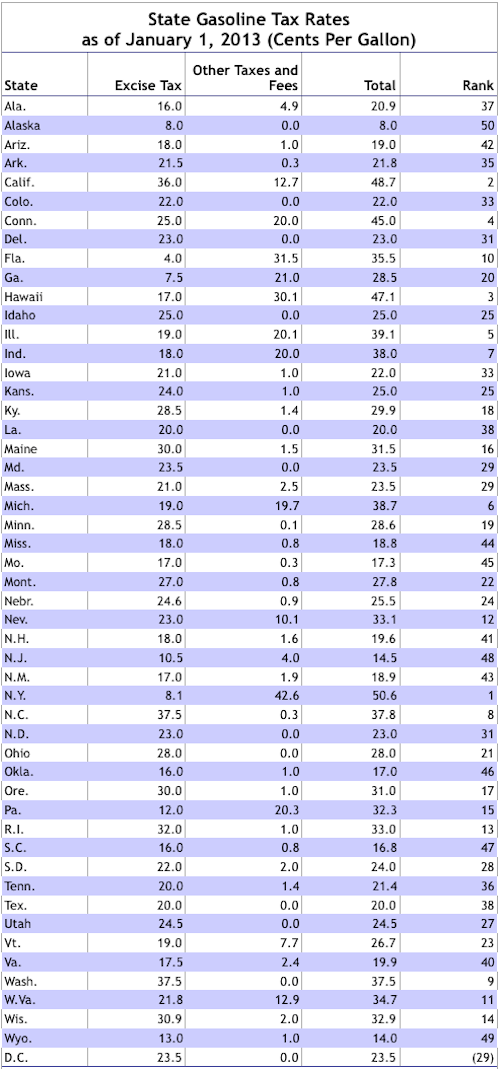

Florida is #1 with 730 miles of toll roads has a 4.0 excise tax and total tax of 35.5 and ranks 10th tax wise.. Oklahoma is #2 at 597 miles, 16.0 tax and 17.0 total tax and ranks 46, Penn takes #3 and has 558 miles, 12.0 tax and 32.3 total tax , and ranks 15th, and New York comes in 4th at 535 miles, only an 8.0 tax and 50.6 total tax, and ranks 1.

So there really is no rhyme or reason for road expenses. A low excise tax….they just make it up by charging ‘other’. It use to be toll roads connected the cities (ie Oklahoma or Penn. and those using them paid most of the cost of upkeep) but more and more, toll roads are finding their way into the urban core (ie Austin). In many places, the toll road is the expressway and you pay or you’re stuck in traffic with the common folk.

I think there are certainly places where toll roads are appropriate but too many times they are just another way republicans try to ‘privatize’ governmental functions which in reality just allows a middle-man company to profit instead of the state…and that profit does not go into repairing the out-dated infrastructure in low-use areas of the states.

Why do roads have to be a government function? If a private company can run and maintain them better, I don’t see an issue. Take Illinois for example. They can’t finish existing projects because of funding, would you like to send tax money up to IDot and hope they chose to finish the project in your area or give a toll to a private company that has to maintain their road otherwise people will stop using it. It’s an oversimplified example, but it does make sense.

Not true. Taking your example..what makes you think a private company is going to build in low-use areas? And if you think that non-repairs make people use other roads, then you haven’t been up East. There are many sections of toll roads in the Northeast that are worse than the interstates…people use them because they are usually the most direct way. Another example are toll bridges…there are many tool bridges that are in deplorable condition. At least with States being in charge, there is some form of bipartisanship and equality (rural -urban spending).

Equity is a matter of perception. Is it more important to rebuild a bridge on a rural road that only sees a truck go by every 15 or 20 minutes? To make Highway K into a four lane highway in St. Charles County to accommodate (encourage?) suburban growth? To rebuild the sidewalks and add bike lanes along Manchester and Chippewa, while reducing the number of travel lanes? If we want to encourage density and urban living, letting private companies build toll roads in growing suburban areas would leave more money to maintain existing infrastructure in established urban and rural areas.

Ask the people in the rural areas. They ask: Why is it more important that Highway K gets expanded to 4 lanes while I have to travel 40 miles out of my way because a bridge collapsed? Why do bikers in the big city get new paths yet I’m stuck with gravel roads?

I’d take a guess that in terms of percentages there are more DOT roads and bridges that are in “deplorable” condition than there are toll roads. I’d still rather have a choice of paying for a toll road over getting my gas taxed even more. I don’t see any concrete evidence that tells me that States or Federal governments do any better job maintaining roads (Hell take your pick… schools, roads, healthcare cost) than anyone else does.

At some point we have to consider the idea that we might have overbuilt our highways when we should have been focusing that money on better public transportation, while I would miss an expanded highway 55, I’d take metrolink being expanded out toward rural areas (a la Chicago) over more roads. Same goes for rural roads as well, at some point it’s not worth spending the money to get a straight line road between each city, no matter how much we want it.

Of course the % would be higher, especially since the total number of toll roads and bridges is miniscule in comparison. Government is good in making sure that at least some minimum of standards are met…schools, roads, healthcare, etc.

Funny how people don’t want to pay any more in taxes but then are quick to point to a service that is paid for with OTHER people’s tax money. Do you really think that our Metro or any metro system really pays for itself with zero costs to taxpayers not using it? Hell, whether you like it or not, you’re paying for Chicago’s Loop, Portland’s, and all the rest of them through Federal subsidies.

So like it or not, roads are still the cheaper way to go.