Becoming An Independent Uber Driver

I have no doubt that Uber will soon be operating in St. Louis, as the Post-Dispatch explains, they’ve never lost against local regulations designed to protect the established taxi industry. But, we must consider the ramifications:

I have no doubt that Uber will soon be operating in St. Louis, as the Post-Dispatch explains, they’ve never lost against local regulations designed to protect the established taxi industry. But, we must consider the ramifications:

Uber operates mainly in big cities like San Francisco and New York, chock full of liberals. Liberals have been caught up in the cult-like enthusiasm for Uber, demanding it in communities where it wasn’t offered and viewing its absence as evidence that their cities didn’t measure up on the tech-savvy cool-meter.

Getting Uber may offer immediate gratification. But communities must understand what it portends, which is more trouble for the middle class. An Uber driver may average about $16 an hour in pay, after deducting the cost of insurance and gas and mileage on their cars. But he probably doesn’t work full time for Uber nor receive benefits. He’s probably going to need another job or two to make ends meet. This doesn’t sound much like progress.

There’s another word that is sometimes used to describe the new, Uberized labor market — the serf economy. (Editorial: Uber is changing more than just transportation)

Manu of you may be ready to sign up as Uber drivers. Just like taxicab drivers, Uber considers its drivers to be “independent contractors”, not employees. What does this mean to you?

People such as doctors, dentists, veterinarians, lawyers, accountants, contractors, subcontractors, public stenographers, or auctioneers who are in an independent trade, business, or profession in which they offer their services to the general public are generally independent contractors. However, whether these people are independent contractors or employees depends on the facts in each case. The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. The earnings of a person who is working as an independent contractor are subject to Self-Employment Tax.

If you are an independent contractor, you are self-employed. To find out what your tax obligations are, visit the Self-Employed Tax Center. (IRS: Independent Contractor Defined)

The first thing you should wonder about is the “self-employement tax” mentioned above:

Self-employment tax is a tax consisting of Social Security and Medicare taxes primarily for individuals who work for themselves. It is similar to the Social Security and Medicare taxes withheld from the pay of most wage earners.

You figure self-employment tax (SE tax) yourself using Schedule SE (Form 1040). Social Security and Medicare taxes of most wage earners are figured by their employers. Also you can deduct the employer-equivalent portion of your SE tax in figuring your adjusted gross income. Wage earners cannot deduct Social Security and Medicare taxes. (IRS: Self-Employment Tax (Social Security and Medicare Taxes))

Depending upon your situation, this many not be applicable to you. I’m not an accountant, but I’ve been an employee, an employee & independent contractor concurrently, and just an independent contractor. From my own personal experience I can tell you it’s important to know the differences.

Why you ask? If you get paid say $1,000 from Uber, some of that money may need to be set aside to cover taxes you’ll owe on the income. This tax money might even need to be paid monthly or quarterly. Don’t forget about state and local taxes too.

Additional considerations:

- You’ll also need a system for keeping track of vehicle expenses (fuel, miles driven, maintenance).

- You may need different auto insurance.

- If your car is financed, would driving for Uber violate any terms of the finance agreement? Uber’s financing is described as a “risky-bet.”

When you get a job your employer takes care of much of the above concerns. If you decide to drive for Uber, or similar, then you’re starting a new business. Accept that — or do like others have and sue:

As you may have heard, the on-demand car-service juggernaut lost a case early this month before the California Labor Commissioner on whether a driver was an independent contractor or an employee, and thus eligible for expense reimbursement. Uber is appealing that ruling in court, but it already faces a class-action lawsuit over the same issue in federal court in California and similar fights in Floridaand Massachusetts.

These legal battles have actually become pretty common lately for car services and taxi companies, not just Uber. Sometimes the issue is that drivers who clearly are employees (they don’t own the cars, they only drive for one service) are treated as independent contractors by skinflint car-service owners. More often than not, though, it is cases like Uber’s, where drivers own their cars, can drive for other services and can set their own timetables — all attributes of an independent contractor — but are dependent on the service in ways that make them seem not quite independent. (Bloomberg View: Uber and the Not-Quite-Independent Contractor)

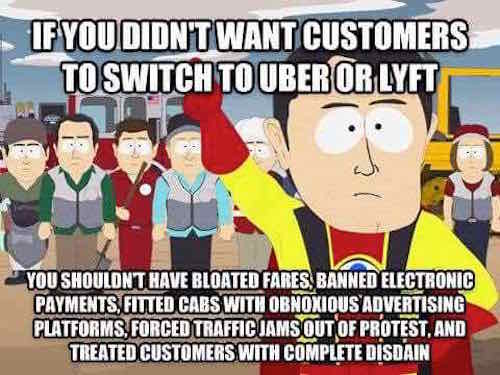

The taxicab companies, for their part, are looking like dinosaurs. Our taxicab experiences in Chicago have been much more positive than here.

Time marches on, this industry will look totally different in 5 years time.

— Steve Patterson

Just another step into the part-time economy . . . for all the talk about raising the minimum wage, this is just another step backwards from full-time employment . . .

Funny, long before Uber and Lyft, et. al., came along, I read plenty of stories about how cab drivers were living in poverty.

Any how many of these full-time “employees” ever had employer-provided health insurance to begin with?

And as far as I know, all cab drivers in St. Louis are independent contractors, not employees. e.g.

http://lacledecab.com/now-hiring/

http://countycab.com/drivers

Agree . . . and the one thing that Uber does do, to address a major negative operating condition, for traditional taxis, is going cash free. Getting robbed, and potentially killed, has been one negative “part of the job” for traditional hacks . . .

Right… I’m not particularly a fan of Uber but it is hilarious how some are trying to tout the cab companies as some kind of upstanding employers when they basically screw cabbies.

On the independent contractor issue, however, the Mo Supreme Ct. just this past May agreed with the state that Laclede Cab indeed had an employer-employee relationship with its drivers and owed unemployment taxes, etc. and I believe some wages. I think this is a case-by-case basis though so it wasn’t industry wide ruling,

Good / amusing analysis: http://dougdemuro.kinja.com/if-taxis-had-apps-i-wouldn-t-use-uber-1721129158

Ha, if they wanna drive they should just get a job at a LOCAL St. Louis company like these movers http://www.cordmoving.com/employment/ – but I digress…