Meeting Rapper Killer Mike’s $100 Challenge In St. Louis

I first learned about rapper Killer Mike during the 2016 presidential primary, see At a Bernie Sanders rally, an Atlanta rapper makes his political debut and How Killer Mike Became Rap’s Most Influential Political Leader. So it was no surprise he was part of an MTV/BET town hall last month. He suggested to everyone there and watching, to invest in black-owned banks — and many have responded:

Citizens Trust Bank — anchored in metro Atlanta, Columbus, Ga., Birmingham, Ala., and Eutaw, Ala. — said it has received about 8,000 new applications for depositors in recent days.

One of the catalysts: Rapper Killer Mike called in to a town hall meeting on MTV and BET on July 8 to implore the black community to deploy “a portion” of its financial resources to make a difference.

He wants 1 million people to deposit $100 apiece in small black-owned banks or credit unions, believing that those financial institutions will be more likely than other banks to make loans to black citizens and businesses — and more likely to treat them fairly in general. (USA Today: Black-owned banks get rush of new depositors)

The above linked to a VH1 story:

During the event, radio personality Charlamagne spoke with rapper Killer Mike on economic solutions for the Black community. “We can’t go out in the street and start bombing, shooting, and killing, Mike preaches. “I encourage none of us to engage in acts of violence. I encourage to take our warfare to financial institutions.”

The rapper proposes that we all should take a portion of our money and “put it into a small black bank or credit union” and watch it accumulate over the next few years. His proposal: for 1 million people to start a $100 account with any Black-owned bank. The result: it gives these small banks the ability to give out small home and business loans for areas that are being gentrified, so Black families don’t get pushed out and their businesses can thrive. (VH1: This Major Star Agrees with Killer Mike’s Economic Solution)

This made perfect sense to me, so I thought I’d see about opening an account at a black-owned bank in St. Louis. The VH1 article provide a link to make it easy to support such a bank, which led me to:

There are 22 African American owned banks (AAOBs) with assets totaling approximately $4.6 billion in assets or approximately 0.43 percent of African America’s $1.1 trillion in buying power. (HBCU Money’s 2016 African American Owned Bank Directory)

Their criteria is based on 51% ownership, here are their key findings:

- “AAOBs are in 17 states and territories. Key states absent are Florida, Mississippi, New York, and Ohio.

- Alabama, Georgia, Illinois, Tennessee, and Wisconsin each have two AAOBs.2016 Median AAOBs Aseets: $107 551 000 ($113 470 000)*

2016- Average AAOBs Assets: $210 292 000 ($233 583 000)*

- African American bank assets saw a 1.2 percent decrease or net loss of approximately $57 million in assets in 2015.

- AAOBs control 0.03 percent of America’s $15.7 trillion Bank Owned Assets.

- AAOBs control 2.3 percent of FDIC designated Minority-Owned Bank Assets, which is down from 2.6 percent in 2015.

- There has not been an AAOB started in 16 years.

- Only 8 of 2016’s 22 AAOBs saw increases in assets.

- For comparison, Asian American Owned Banks have approximately $46.1 billion in assets spread over 68 institutions. They control 6.0 percent of Asian America’s buying power.

*Previous year in parentheses”

What about in St. Louis? Nada. the nearest are two options in Chicago: ISF Bank/Illinois Service Federal Savings & Loan Association and Seaway Bank & Trust, founded in 1934 & 1965, respectively.

The USA Today article linked to the Federal Reserve’s Minority-Owned Depository Institutions:

Total number of institutions 156

Total assets (thousands $) $131,324,491

Total deposits (thousands $) $107,712,933Number of institutions by minority code (Min Cd)

1 Black or African American 23

5 Caucasian Women 6

10 Hispanic American 29

20 Asian or Pacific Islander American 61

30 Native American or Alaskan Native American 18

31 Multi-Racial American 1

32 Min Board & Serving African American Community 1

33 Min Board & Serving Hispanic Community 4

34 Min Board & Serving Asian or Pacific Islander Community 9

35 Min Board & Serving Native Am or Alaskan Native Am Community 0

36 Min Board & Serving Multi-Racial Community 2

39 Low Income Credit Union 2

Total 156

With 156 institutions one must be located in St. Louis, right? Nope.

In the entire state of Missouri here are the Minority institutions:

- Liberty Bank & Trust: 2 locations in Kansas City

- Central Bank of Kansas City: 2 locations in Kansas City

- Peoples Bank: Seneca & Joplin, MO

St. Louis did have a local black-owned bank for 44 years, from 1965-2009:

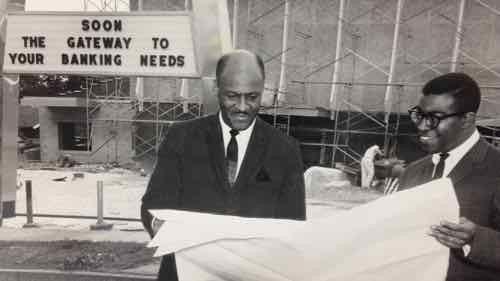

Gateway Bank was established in 1965 on Union Blvd., near Natural Bridge, as the first black-owned and -operated bank in Missouri. In response to the 1963 civil-rights protests of Jefferson Bank & Trust Co.’s refusal to hire blacks, co-founder C. W. Gates and his family committed to providing banking services and loans indiscriminately to the community of North St. Louis.

“Over the years, Gateway took local deposits and made loans in a neighborhood where few other banks focused,” said Adolphus Pruitt, president of the NAACP St. Louis City.

In 2009, the bank failed under the recession, was taken over by the FDIC, and was sold to Central Bank of Kansas City. For the past three years, Central Bank was managing the bank’s $12 million in deposits and about $13 million in assets. Yet earlier this year, Central Bank received permission from the FDIC to permanently close the location in October 2012, arguing that they couldn’t find a buyer to keep the bank open.

(St. Louis American: Gateway Bank Saved)

Gateway Bank was formed after the 1963 Jefferson Bank Protest. I used to pass Gateway Bank while riding my bike to work further North on Union Blvd in the late 90s — I was unaware of its history.

However, this isn’t the end of the story.

In 2012, St. Louis Community Credit Union announced plans to save Gateway Bank by purchasing the existing land. The building was demolished in 2015. With the help of additional funding from a Community Development Block Grant, as well as support from the City of St. Louis, Stifel Bank & Trust, the St. Louis City NAACP, TIAA Direct

and others, St. Louis Community Credit Union built a new state-of-the art facility on the original site, while still preserving the great heritage of Gateway Bank.

Many of Gateway’s traditions continue in the new financial institution. It opened in March 2016. (gatewayslccu.com)

Will I be going here to open a new account? No, because I’ve already been a member of St. Louis Community Credit Union since 2010. We got our car loan there in 2014 and will get another in late 2017/early 2018.

Last week I took the #04 MetroBus to see the new Gateway branch.

The following hour plus video was produced in 2015 to look back at the history of Gateway, here is a list of the people interviewed:

- Russel Little, Sr., former Gateway shareholder

- Barbara Harness, Gateway SVP of operations

- Mike McMillan. Urban League

- Thomas L. Mines, Gateway employee 1968-1975

- Dr. John A Wright, Educator/Historian/Author

- Delores Jones, former Gateway employee, now a St. Louis Community Credit Union employee

- Letrissa Bennet, former Gateway employee, now a St. Louis Community Credit Union employee

- Lisa Gates, daughter of Gateway xo-founder CW Gates and former employee

I listened to the entire video, very interesting. If your among the many who are unbanked in St. Louis or your money is elsewhere, please talk to St. Louis Community Credit Union.

— Steve Patterson

Great challenge. And Killer Mike should issue another challenge to every drug user in his community: to exercise self-control and to deposit into the same banks the next $100.00 originally set aside for the next drug buy. This will widen the window of opportunity for perhaps a different segment within the community to contribute to the health of its banking institutions and to the overall health and welfare of the community.

The drug users & pushers are in the affluent suburbs! http://www.cbsnews.com/news/suburban-family-accused-of-running-drug-lab-in-sprawling-home/

I don’t deny that affluent neighborhoods have their share of drug problems. In the context of this discussion, however, no one that I’m aware of has suggested that a million community members of the affluent communities each deposit $100.00 into local, community banking institutions. In my post I suggested, again in the context of this discussion, simply that those in these inner city communities who do engage in purchasing, abusing and selling drugs consider, for the sake of their community, investing in their banking institutions rather than in drug activity, so that their fellow community members might ultimately benefit. “It takes a village” –true, but next door neighbors also have a responsibility to do their part. And just think of the cash that would be deposited if those neighbors were so inclined to give a damn.

Slightly related – a good article on gentrification: http://www.oregonlive.com/portland/index.ssf/2016/08/real_estate_agent_some_african.html