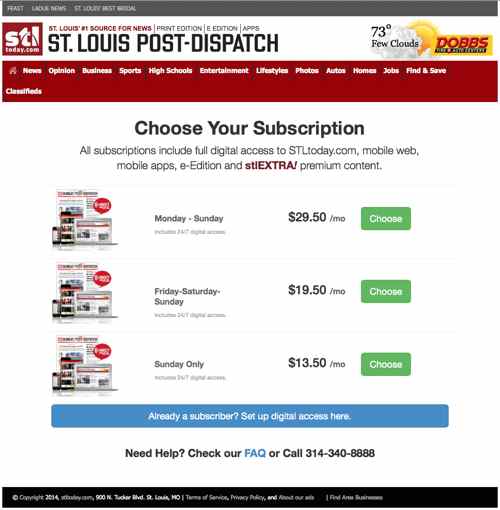

Subscribe to stltoday.com, get Sunday Newspaper Delivered Free

The St. Louis Post-Dispatch, aka stltoday.com, now has some digital-only content for subscribers.

Full digital access includes 24/7 digital access to STLtoday.com, mobile web, mobile apps for iPhone and Android smartphones, an iPad app, e-Edition and stlEXTRA! which is additional premium content and exclusive storytelling on STLtoday.com (source).

I know many current & former staff at the Post-Dispatch, I like the idea of paying for content to support their work. That said, I’m 47 and have never had a newspaper subscription. My parents got the Daily Oklahoman delivered everyday, but it was a habit/expense that never interested me. I’d bought a few papers over the years so I knew they were more expensive, thinner, and smaller. Still, I had no clue how much a newspaper subscription cost. In my mind, however, I thought digital access should be less.

No trees to cut down to make newsprint, no need to run the presses, no need to deliver the paper to my address. Apparently the folks at the Post-Dispatch/Lee Enterprises see this differently.

For $13.50/month, or $162/year, you can get the Sunday edition delivered and get “full digital access” described above. Or for the exact same $13.50/month ($162/year) you can get the “full digital access” without the Sunday paper. Put another way, the Sunday newspaper is so worthless they can’t charge anything for it over and above digital access. Is the norm?

So I started to look at subscription rates in other cities:

Kansas City Star (McClatchy newspaper group)

- Digital-only: first month 95¢, $9.95/month thereafter. This is $109.45 for the first year, $119.40/year thereafter.

- Wednesday/Sunday/Digital special offer: $1.00/week + tax

- Print 7-days/Digital special offer: $/month, $/year

- “26-week Home Delivery Options Offer limited to regular carrier-delivered routes and valid only for new subscribers who have not subscribed within the past 30 days. Subscription will continue at the prevailing full-price rate once introductory special expires unless The Star Co. is notified otherwise.” I have no idea what the “prevailing full-price rate” is.

- “Subscription rates include a separate fee for delivery. Tax rates vary by location and will be reflected on your billing statement.”

Daily Oklahoman (Anschutz Corporation)

- Digital ala carte: $9.95/month

- Full Digital: $15/month

- Wednesday/Sunday/Digital: $12/month, $144/year

- Print 7-days/Digital: $19.50/month, $234/year

The Indianapolis Star (Gannett)

- Subscribe Now and Get Your First Three Months for the Price of One!*

- Digital only: $12/month, $144/year

- Thursday/Sunday/Digital: $14/month, $168/year

- Print 7-days/Digital: $26/month, $312/year

Minneapolis Star Tribune (Billionaire Glen Taylor)

- Special offers for new customers, below are their regular rates

- Digital-only: $2.99/week, $155.48/year

- Sunday/Digital: $4.24/week, $220.48

- I was unable to find the rate for 7 days of the print edition.

After these four I’ve had enough, it’s clear to me newspapers use the same tricks as phone & cable providers to hook you with low introductory offers. The other thing I see is they’re pricing their digital options so people will take at least the Sunday print edition too. Some may like the idea but as a person who doesn’t want a physical paper I don’t see the value in a digital subscription. The rates are structured to offer a bonus to print subscribers, but aren’t attractive to me as a person who’s never subscribed before.

I like the idea of a digital subscription for our household, 5 devices is perfect (we each have a computer & iPhone, plus a shared iPad). Our internet is included in our condo fee, we have separate contracts with AT&T for our smartphones, our television service is free (over the air), but we do pay for NetFlix streaming plus one DVD at a time. I’m not sure how much per month I’d be willing to pay for digital access to the Post-Dispatch, but not $13.50/month!

Ok, I decided to look up one more newspaper, The New York Times:

- Web/smartphone: $3.75/week, $16.25/month, $195/year

- Web/tablet: $5/week, $21.67/month, $260/year

- Full digital: $8.75/week, $37.92/month, $455/year

- According to Mashable, 61% of NYT subscriptions are digital.

I tend to use the Post-Dispatch iPhone app daily, but I rarely use their iPad app. For me I’m willing to pay say, $5-$8/month, $60-$72/year. In fact, I’d be interested in paying for 6-12 months up front if it saved me a little over the monthly price. I just don’t see newspapers doing anything to convert this non-subscriber into a subscriber. Giving me the bulky Sunday paper that’ll quickly fill our recycling is a disincentive to subscribe.

Of course, the Post-Dispatch has no obligation to try to please me. But I’m not alone:

- The mobile audience skews young; the median age of an adult newspaper mobile user is 17 years younger than the print reader.

- Those who are newspaper mobile-exclusive—that is, those who access newspaper content on mobile devices only—are younger by four more years (with a median adult age of 33). That audience grew 83% in 2012 compared with a year ago.

- Source: Newspaper Association of America.

It seems to me they really need to get mobile/web-only readers to subscribe, but the current options aren’t the answer.

— Steve Patterson