Voters Could Always Decide on Earnings Taxes

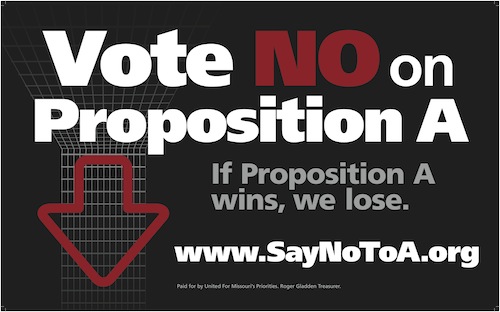

I urge every voter in Missouri to vote NO on Proposition A on Tuesday. Â I’ll explain why but first I want to examine the arguments in favor.

I urge every voter in Missouri to vote NO on Proposition A on Tuesday. Â I’ll explain why but first I want to examine the arguments in favor.

The slogan for passage is “let the voters decide.” Sounds logical enough, why shouldn’t we get to decide? From the pro-A website:

If Prop A passes in November, will the local earnings taxes automatically be eliminated in St. Louis and Kansas City?

Prop A does not automatically repeal those existing earnings taxes. It allows local voters to make that decision in local elections. If Missouri voters pass Prop A this November, the politicians will be required to allow local votes of the people on the existing earnings tax in St. Louis and Kansas City every five years, starting in 2011. These local votes will let voters decide for themselves if they want to continue their local earnings tax or gradually phase it out at the rate of one-tenth of one percent per year for 10 years.

Okay here is where I have  a problem with their wording.  “It allows local voters to make that decision in local elections” makes it sound like we must pass Prop A in order to have a local election on continuing to have an earnings tax or eliminate it and get the 1/3 of our annual revenue through other taxes. This is just not true!

Anyone with a better idea on how to fund St. Louis & Kansas City could use the initiative petition process to propose changes that would reduce/eliminate the earnings tax.

“1. Article V of the City Charter provides a procedure by which registered voters may propose an ordinance or an amendment to the City Charter and have it adopted by the voters, with the same effect as if it had been enacted by the Board of Aldermen and approved by the Mayor. This procedure consists of gathering the signatures of registered voters on an initiative petition.”

But the wealthy backer of Proposition A, Rex Sinquefield, knew if he got petitions on the ballot in St. Louis & Kansas City that spelled out how our sales taxes and property taxes would increase up to 50% to make up for the loss in revenue from the earnings taxes that he wouldn’t stand a chance.

“Their next sentence is “If Missouri voters pass Prop A this November, the politicians will be required to allow local votes of the people on the existing earnings tax in St. Louis and Kansas City every five years, starting in 2011” Clearly they are playing to the anti-politician sentiment we’ve been seeing nationally. Sounds like making the politicians do something, making them give us the right to reconsider the earnings tax every five years.  So?

The translation is this gives Rex Sinquefield numerous times to personally fund the campaigns to end the earnings tax in St. Louis & Kansas City.  It also means when either city goes to sell bonds to finance projects the bond rating will be higher causing a higher interest rate, potentially sidelining projects that might be able to be funded today.

Governments provide services and people pay taxes to fund those services. Â There are many ways to fund governments. Â St. Louis and Kansas City are both on the state line and have workers paying the tax that don’t live in the city. Â Some live elsewhere in Missouri while others live in Illinois and Kanas, respectively. Â Both cities provide services within each region that benefit those workers as well as their respective regions.

I have no love affair with the earnings tax and would gladly look at alternative funding concepts. Â But until such alternates actually exist we don’t need to be trashing our bond rating and risking future projects. One-third of the St. Louis budget is a lot to try to make up elsewhere.

More info can be found at SayNoToA.org.

– Steve Patterson