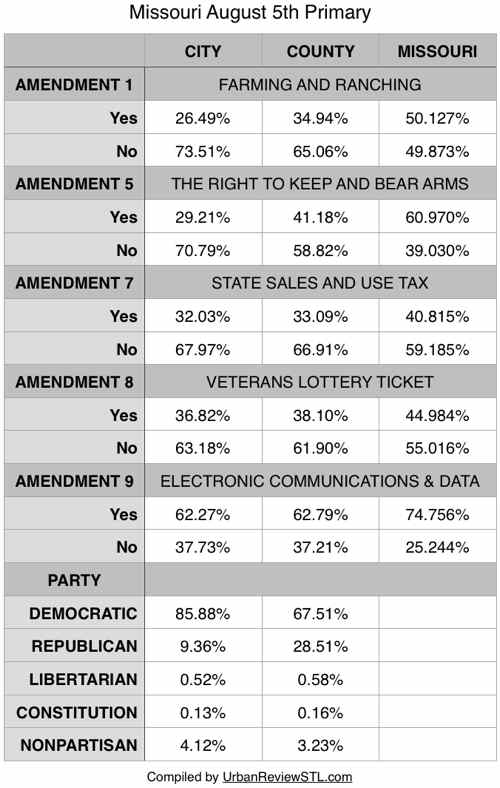

St. Louis City & County Voters Rejected Same Four Amendments, Two Approved Statewide

A decade ago Missouri voters amended our state constitution to ban same-sex marriage, but the majority of voters in the City of St. Louis voted no. As is often the case, city voters differed from state voters. I’ve not looked at previous elections, but this year voters in St. Louis County voted against the same four amendments. Two amendments city & county voters rejected, Amendments 1 & 5, were approved by statewide voters.

I couldn’t locate statewide information on the number of ballots cast from each party, most likely greater than half were Republican.

The amendment that received the most votes was #7, a 3/4-cent sales tax for roads.

Transportation officials have been working for more than a decade to find more money. In 2002, voters defeated a proposed $483 million sales and fuel tax increase.

“There is no perfect solution,” said Kehoe, the sponsor. He said Amendment 7 was crafted around polling that showed a sales tax was most likely to pass at the polls. He said the fuel tax would have to be raised 20 to 25 cents per gallon to generate the money needed. (stltoday)

As you’ll see, Missouri has long resisted increases in the fuel tax. Here is the text from MoDOT’s funding history page:

Funding History

2008

In July, the start of fiscal year 2009, Amendment 3 is fully phased-in, providing MoDOT with all of the motor vehicle sales tax revenues previously going to General Revenue.

MoDOT sold bonds for a portion of the new Interstate 64, a design-build project in the St. Louis region. For the first time, MoDOT secured bonds primarily with federal funds, rather than state funds. These bonds are called Grant Anticipation Revenue Vehicle (GARVEE) bonds.

2004

In November, Missouri voters approved Constitutional Amendment 3, which requires all revenues collected from the sale of motor vehicles come to MoDOT. Previously, half of the sales tax went to MoDOT and half to the state’s general revenue fund. It requires the Missouri Highways and Transportation Commission to issue bonds for building highway and bridge projects and uses these additional revenues to pay back the bonds over a period of time. The additional Amendment 3 revenues are to be phased-in over a 4 year period in 25 percent increments.2002

Legislation is passed extending the 6-cents-per-gallon motor-fuel tax, which was due to expire in 2008. Proposition B, an omnibus transportation bill that would have increased the motor-fuel tax by 4 cents per gallon and the general sales tax by 1/2 percent, is defeated by voters by a 3-to-1 margin.2000

Legislation was passed, effective May 30, 2000, allowing MoDOT to issue $2.25 billion in bond financing to accelerate highway improvements. Up to $250 million in bonds can be issued in 2000 and up to $2 billion from 2001 through 2006. Projects funded by the first $250 million were required to come from MoDOT’s 5-Year Statewide Transportation Improvement Program. MoDOT can issue up to $500 million per year in bond financing through the year 2006. MoDOT submits a bond financing project list to the Legislature each January for approval.1992

A 6-cent per gallon increase in the motor fuel tax is passed by the Legislature. The 6 cents is to be phased in over a 5-year period; 2 cents in 1992, 2 cents in 1994 and 2 cents in 1996.1987

Proposition A, a constitutional amendment to increase the motor fuel tax by 4 cents per gallon, is approved by the people. It becomes effective June 1.1984

Fees for motor vehicles and truck classes not raised in 1983 are increased.1983

Fees for some classes of trucks are increased.1982

Proposition B, a constitutional amendment to raise the motor fuel tax by 4 cents per gallon, is defeated by the people.1979

Voters approve a constitutional amendment changing the CART distribution formula. Counties receive 10 instead of 5 percent, cities receive the same 15 percent and the state receives 75 instead of 80 percent. The law is effective Jan. 1, 1980. The amendment also merges the Highway Department with the Transportation Department. Also included in this legislation is a provision that one-half of the motor vehicle sales tax go to finance road and bridge construction. Of this half, 74 percent would go to the state, 15 percent to the cities and 10 percent to the counties. The remaining 1 percent goes for planning of other transportation modes.1978

An initiative petition to increase the fuel tax 3 cents per gallon is defeated.1972

The Legislature passes a bill increasing the gas tax from 5 cents to 7 cents per gallon.1961

The Legislature passes a bill temporarily raising the fuel tax from 3 cents to 5 cents per gallon. The bill provides that a constitutional amendment be put before the people which would allow cities and counties to share in state motor fuel tax revenues. If the amendment is not submitted within six months, or if it is rejected, the tax would revert to 3 cents. Voters approve the amendment on March 6, 1962, and the 5-cent per gallon tax becomes permanent. This act establishes the County Aid Road Trust program.1952

On March 24, an act is approved increasing the motor vehicle tax from 2 cents to 3 cents per gallon. The law becomes effective July 29.1950

On April 4, Missourians again reject a referendum proposal to increase the motor vehicle tax. The proposal would have increased the tax from 2 cents to 4 cents per gallon.1938

On Nov. 8, the people defeat by referendum election an attempt of the Legislature to raise the fuel tax from 2 cents to 3 cents per gallon. At the same time, an initiative petition proposal to amend the Constitution to fix the fuel tax at 3 cents for 10 years is also defeated.1924

A 2-cent tax rate for motor vehicle fuel is adopted by a vote of the people under initiative petition. It is the state’s first motor fuel tax.

From the above I made this list of the fuel tax rate since 1924:

- 1924 2-cents

- 1952 3-cents (28 years, 100% increase)

- 1961: 5-cents (9 years, 66% increase)

- 1972: 7-cents (11 years, 40% increase)

- 1987: 11-cents (15 years, 57% increase)

- 1992: 13-cents (5 years, 18.18% increase)

- 1994: 15-cents (2 years, 15.38% increase)

- 1996: 17-cents (2 years, 13.33% increase)

It has now been 18+ years since the fuel tax was increased, the only period longer was the first increase after the initial tax! Had the 1990s 2-cent increase every two years continued we’d be at 34-cents — double the current rate. We’d still be lower than Illinois and many other states. Amendment 7 proponents say voters rejected a 2002 attempt to raise the fuel tax rate. From above: “Proposition B, an omnibus transportation bill that would have increased the motor-fuel tax by 4 cents per gallon and the general sales tax by 1/2 percent, is defeated by voters by a 3-to-1 margin.” They’d proposed a measly 4-cent fuel tax increase combined with a 1/2-cent general sales tax. I don’t recall how I voted a dozen years ago, but I likely voted no based on the general sales tax increase.

Here’s what should happen:

- The Missouri legislature should pass legislation to double the fuel tax from 17-cents to 34-cents over the next 5-10 years.

- The Missouri legislature should pass legislation make I-70 a toll road between Kanas City and St. Louis. This revenue, not the fuel tax, would be used to widen I-70.

We do need to maintain our infrastructure, we should be cautious about adding to the system if we aren’t willing to raise the fuel tax. Why build more miles of highway if we can’t maintain what we have now?

— Steve Patterson