McKee’s Northside Regeneration Moving Forward

|

|

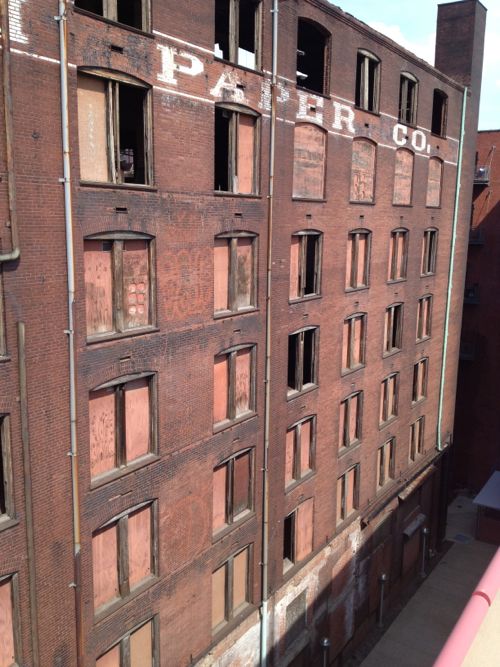

As you’ve likely heard by now, last week the Missouri Supreme Court overturned a 2010 ruling that Paul McKee’s Northside Regeneration development plans were too vague for TIF financing:

After over 3 years of litigation, developer Paul McKee’s controversial Northside Regeneration Project is being allowed to proceed. On Tuesday the Missouri Supreme Court reversed a lower court decision blocking McKee’s use of so-called “Tax Increment Financing,” (TIF) for the development. (St. Louis Public Radio)

I’ve never been thrilled about how McKee handled property acquisition and maintenance, but I recognize the city’s total absence of planning and working toward a common vision left an opening for private interests without public input.

The project area is large but it’s a fraction of the city as a whole. There are many other parts of the city, north & south, dealing with continued population decline, increases in vacant buildings, and other signs of decay. Where’s the people upset the city isn’t doing anything to solicit public input in the rest of the city? Transportation, housing, jobs, education, etc are all being ignored.

The Jaco report just had Paul & Midge McKee on taking about their project, see the video here.

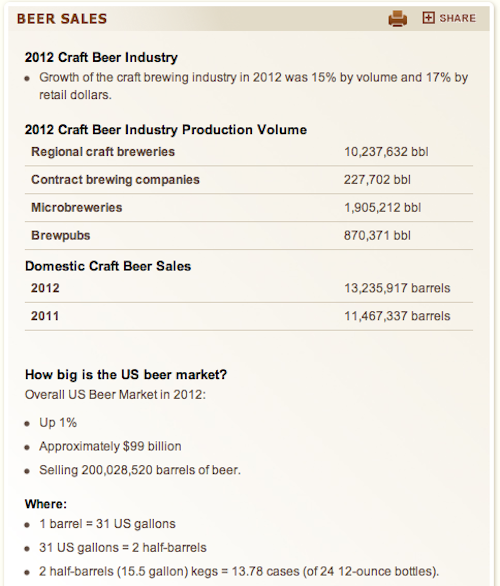

One of the biggest issues is the massive TIF (tax increment financing) package for the project. What needs to be understood is the pros and cons of the TIF tool. When a municipality invests in new infrastructure in stable and up & coming areas few tend to object since people see the value of improving desirable locations. Conversely, this means declining areas don’t see improvements in public infrastructure (sidewalks, roads, sewers, lighting, etc). Both are self-fulfilling in that rebuilding public infrastructure in the sable/improving areas further helps these areas while the lack of infrastructure investment in others accelerates decline in others.

Begin replacing sidewalks & lighting in sparsely populated declining neighborhoods and people will quickly question the return on that investment. This is where the TIF tool come in, a private developer agrees to invest in a blighted area and pay much more in property taxes than the municipality currently collects but only in part of that tazx is used to pay off bonds used to rebuild the public infrastructure the municipality can’t afford to rebuild otherwise.

The developer needs the new infrastructure to attract investors/buyers/tenants but the municipality can’t rebuild the infrastructure without a way to pay for it. The municipality can’t risk existing revenues to pay off bonds to rebuild the infrastructure so that means new revenue must be used. Sales taxes are a bad source for these revenues

- Residential & office development don’t pay sales taxes

- Sales taxes would take too long to accrue

- Our sales tax rate is already sky high

This leaves property taxes as a source of revenue. To simplify things say the property is paying $100/year in property taxes but after redevelopment the property taxes will now be $200/year. With the TIF the municipality/school district would still collect the $100 it always did, $5o (increment) would go to pay off infrastructure bonds and the remaining $50 would go to the municipality/school district. Do nothing get $100/year or do the project and get $150/year.

The actual numbers will be different but you get the point: public infrastructure gets rebuilt, building happens, more taxes are collected than if nothing happened. This is a simplified view and there are cons such as favoritism for the developer(s), risk of pushing out good people, etc.

My concern is St. Louis won’t require good urbanism such as strong pedestrian connections. The infrastructure needs to be rebuilt and TIF is the best way to do that, but we need to have a say on characteristics of the final development.

— Steve Patterson