My Zip Code Has the Lowest Average Credit Scores in the St. Louis Region

A new database uses average credit scores as a measure of a community’s financial wellbeing:

The Financial Wellness Index dashboard and mapping – created in partnership with Experian – provides a unique snapshot of a community’s financial health as measured by the average credit scores of its residents. Credit scores are important because they affect residents’ ability to borrow, the likelihood they can be resilient during difficult times, and their ability to achieve financial goals like purchasing a home or starting a business. — Operation Hope

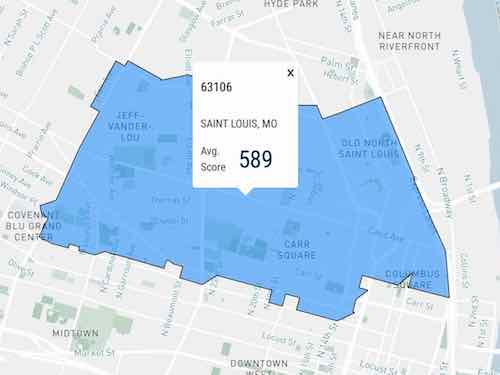

I checked the zip codes for both sides of the Mississippi River and my zip code (63106) was the lowest of all, hence the worst in terms of financial health. There’s a direct correlation between primarily using currency instead of credit cards and having lower credit scores.

Before going further a brief credit score 101 is necessary:

We don’t have just one credit score, we have numerous. There are 3 major credit bureaus (TransUnion, Equifax, and Experian). Each maintains a file on our loans, credit cards, payments, etc. Each will vary slightly from the others, even without errors.

Credit scores are calculated based on information from one of the three credit bureaus, but there are two major formulas used currently: FICO8 and VantageScore 3.0. Both scoring methods use a range of 300-850.

The credit bureaus collect information voluntarily reported to them. Many payments such as utilities, rent, handshake loans, etc haven’t been reported because it involves extra work to do so. When I was a landlord I don’t think there was a way to report payments/delinquencies by my tenants — but technology is changing to allow more into the files.

Ok, end of credit scores lesson.

The Operation Hope database uses Experian data and the VantageScore 3.0 formula. The national average was 698, Missouri & Illinois averaged 694 & 702, respectively. The City of St. Louis had an average of 681. My zip code (63106), just north of downtown & downtown west was just 589.

Downtown (63101) & downtown west (63103) both averaged 645. This is low, but it’s nearly 60 points higher than the adjacent zip code of 63106.

The 7 city zip codes mostly north of Delmar average 604, the highest is 63112 (646)– which includes the Debaliviere & Debaliviere Place neighborhoods. Credit scores in five of the seven north side zip codes are between 589-601. In the rest of the city the lowest average is 619 (63111), the highest is 714 (63139).

What do these numbers mean?

VantageScore rates them as such:

300-499: Very Poor

500-600: Poor

601-660: Fair

661-780: Good

781+ Excellent

Again the average score (Experian/VantageScore 3.0) for my zip code of 11k people is 589. Individually that’s a Poor score. What about from a community perspective? I think the same classifications apply. If the average is 589, what are the low and high scores? After decades of low scores, mine have all been in the classification for over three years now.

Poor credit scores prevent people from getting loans altogether, or at least without paying through the nose interest rates. This might look like buying an overpriced well-use car at a ”we finance anyone” place to get wheels to get to work. The high rate of interest means the payments are steep. The dealer doesn’t care if you pay in full because they can repo and resell to someone else.

While a prospective employer or landlord can’t see your specific score, they can ask your permission to see your credit report. A lack of credit history, or bad history, can mean a person needs to keep looking for a job or apartment.

What does this have to do with cash, printed currency? A lot!

Today, roughly four-in-ten Americans (41%) say none of their purchases in a typical week are paid for using cash, up from 29% in 2018 and 24% in 2015, according to a new Pew Research Center survey.

Pew Research

I’m in that ”none” group. I use cash only for the occasional lottery ticket or very rare medical cannabis purchase. But many are the opposite, using cash for everything. Back to Pew Research:

Americans with lower incomes continue to be more reliant on cash than those who are more affluent. Three-in-ten Americans whose household income falls below $30,000 a year say they use cash for all or almost all of their purchases in a typical week. That share drops to 20% among those in households earning $30,000 to $49,999 and 6% among those living in households earning $50,000 or more a year.

Even so, growing shares of Americans across income groups are relying less on cash than in previous years. This is especially the case among the highest earners: Roughly six-in-ten adults whose annual household income is $100,000 or more (59%) say they make none of their typical weekly purchases using cash, up from 43% in 2018 and 36% in 2015.

There are also differences by race and ethnicity in cash usage. Roughly a quarter of Black adults (26%) and 21% of Hispanic adults say that all or almost all of their purchases in a typical week are paid for using cash, compared with 12% of White adults who say the same.

Pew Research

The areas with the lowest credit scores are the same as those that use cash almost exclusively. Can’t expect a good credit score if you never/rarely use credit!

The part that stumps me is how to change the current paradigm. It’s necessary as the population increasingly goes cashless, otherwise those on the economic fringe will be even more isolated financially they are currently. Future posts on credit scores will look at how the scoring models have improved since their inception, what still needs to be done, how can the region lift scores — and how this will indirectly reduce crime.

— Steve

————————————————————————

St. Louis urban planning, policy, and politics @ UrbanReviewSTL since October 31, 2004. For additional content please consider following on Facebook, Instagram, Mastodon, Threads, Bluesky, and/or X (Twitter).